MARKET OVERVIEW

The 2023 RevPAR (Revenue Per Available Room) growth of 4.9% was driven by moderate GDP growth and inflation, leading to an expected 3.1% rise in Average Daily Rate (ADR) and a 4.1% increase in RevPAR expectations. Despite predictions of a macroeconomic slowdown by Oxford Economics, the U.S. hotel industry, including corporate transient, group, and leisure travel sectors, is on a recovery path. A notable uptick in group travel, especially in Upper Upscale hotels, suggests increased meeting and convention activities for 2024, while leisure travel shows weaker performance in areas like Miami and New Orleans, and corporate transient demand is affected by the slow return to offices.

PERFORMANCE

The industry is seeing positive impacts from slight GDP growth and room rate hikes driven by approximately 3% inflation. Group travel demand remains strong, but corporate transient bookings are lagging due to delayed office re-openings, affecting downtown hotel occupancies. Leisure travel, particularly from international visitors, is still below expectations. However, limited-service hotels are performing well outside major metropolitan areas. Despite the pressure of rising operational costs on profit margins, the prospect of Federal Reserve rate cuts provides a glimmer of hope for margin improvement.

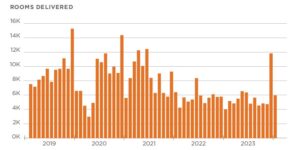

CONSTRUCTION

Hotel construction declines from its pre-pandemic peak, with challenges in securing financing due to higher interest rates. However, the final planning phase sees growth, suggesting potential future activity post-Fed rate cuts. Construction activity is concentrated in the Pacific, Mountain, and South Atlantic regions, with limited-service hotels dominating the pipeline. While full-service hotels are funded selectively, the future focus remains on limited- and select-service establishments.

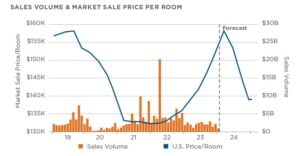

SALES

Hotel sales plummeted by over 50% in 2023 due to challenging deal underwriting amid higher interest rates. However, with the Federal Reserve signaling rate cuts in 2024, market participants are expected to engage more actively. Although overall trading volume decreased, select deals were completed, while some high-profile borrowers ceased supporting their loans, raising speculation about future property trades. Despite the mixed outlook, optimism prevails for the commercial real estate sector in 2024.

ECONOMY

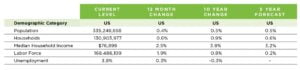

In 2023, the U.S. economy demonstrated remarkable resilience, defying early recession forecasts and the Federal Reserve’s aggressive interest rate hikes aimed at controlling inflation. This economic strength was supported by robust household spending on entertainment and recreational activities, a reflection of the economy’s adaptability and consumer confidence. The labor market remained sturdy, with wage growth outpacing inflation, enabling continued consumer spending despite tightening financial conditions.

As the economy transitions into 2024, inflation has shown a significant downtrend, providing room for the Federal Reserve to potentially ease its policy rates. Although certain sectors like manufacturing and housing face challenges, the services sector continues to thrive, buoyed by persistent demand. With the Federal Reserve and markets anticipating rate cuts, there’s optimism that this could further bolster economic growth and stability, presenting a hopeful outlook for the U.S. economy’s continued resilience and adaptability in the face of challenges.

Sources: CoStar Group, Hospitality National Report, all information as of February 2024. Oxford Economics.